Public Ltd. Company

A Public Limited Company under Company Act 2013 is a company that has limited liability and offers shares to the general public

Swift Swift |

Professional Professional |

Precise Precise |

One Stop One Stop |

PUBLIC LIMITED

Incorporating a Public limited company is a technical task due care should be taken while incorporating a Public limited company. The Government of India has taken various steps to make incorporation process simplifies, however a layman himself cannot incorporate a Public limited company, one has to appoint a professional to complete this task. Now, the companies are incorporated via E-Form SPICe. E-Form SPICe (INC-32) deals with the single application for reservation of name, incorporation of a new company and/or application for allotment of DIN and/or application for PAN and TAN. Once the E-Form is processed and found complete, company would be registered and CIN would be allocated. Also DINs gets issued to the proposed Directors who do not have a valid DIN. Maximum three Directors are allowed for using this integrated form for filing application of allotment of DIN while incorporating a company. Also PAN and TAN would get issued to the Company.

Choose Your Plan

₹10000+GST

CORPORATE IDENTIFICATION NUMBER(CIN)

1 RUN NAME APPROVAL

UPTO 10 LAKHS AUTHORIZED CAPITAL

INCORPORATION FEE

STAMP DUTY

CERTIFICATE OF INCORPORATION(COI)

PAN

DIRECTOR IDENTIFICATION NUMBER(DIN)

DIGITAL SIGNATURE CERTIFICATE(DSC)

EMPLOYEE STATE INSURANCE(ESI)

PROVIDENT FUND(PF)

IMPORT EXPORT (IE) CODE

GST

TAX DEDUCTED AT SOURCE(TDS)

CERTIFICATE OF COMMENCEMENT OF BUSINESS (COB)

GET THIS PLAN @ ₹ 10000/- PLUS GST

₹15000+GST

CORPORATE IDENTIFICATION NUMBER(CIN)

1 RUN NAME APPROVAL

UPTO 10 LAKHS AUTHORIZED CAPITAL

INCORPORATION FEE

STAMP DUTY

CERTIFICATE OF INCORPORATION(COI)

PAN

DIRECTOR IDENTIFICATION NUMBER(DIN)

DIGITAL SIGNATURE CERTIFICATE(DSC)

EMPLOYEE STATE INSURANCE(ESI)

PROVIDENT FUND(PF)

IMPORT EXPORT (IE) CODE

GST

TAX DEDUCTED AT SOURCE(TDS)

CERTIFICATE OF COMMENCEMENT OF BUSINESS (COB)

UDYAM REGISTRATION

SHARE CERTIFICATES

1ST YEAR GST RETURNS

1ST YEAR MCA COMPLIANCE

DIRECTOR REPORT

1ST YEAR DEDICATED COMPLIANCE OFFICER

GET THIS PLAN @ ₹15000/- PLUS GST

₹20000+GST

CORPORATE IDENTIFICATION NUMBER(CIN)

1 RUN NAME APPROVAL

UPTO 10 LAKHS AUTHORIZED CAPITAL

INCORPORATION FEE

STAMP DUTY

CERTIFICATE OF INCORPORATION(COI)

PAN

DIRECTOR IDENTIFICATION NUMBER(DIN)

DIGITAL SIGNATURE CERTIFICATE(DSC)

EMPLOYEE STATE INSURANCE(ESI)

PROVIDENT FUND(PF)

IMPORT EXPORT (IE) CODE

GST

TAX DEDUCTED AT SOURCE(TDS)

CERTIFICATE OF COMMENCEMENT OF BUSINESS (COB)

UDYAM REGISTRATION

SHARE CERTIFICATES

1ST YEAR GST RETURNS

1ST YEAR MCA COMPLIANCE

DIRECTOR REPORT

1ST YEAR DEDICATED COMPLIANCE OFFICER

INCOME TAX AUDIT

INCOME TAX RETURN

1ST YEAR INCOME TAX ADVISORY

GET THIS PLAN @ ₹20000/- PLUS GST

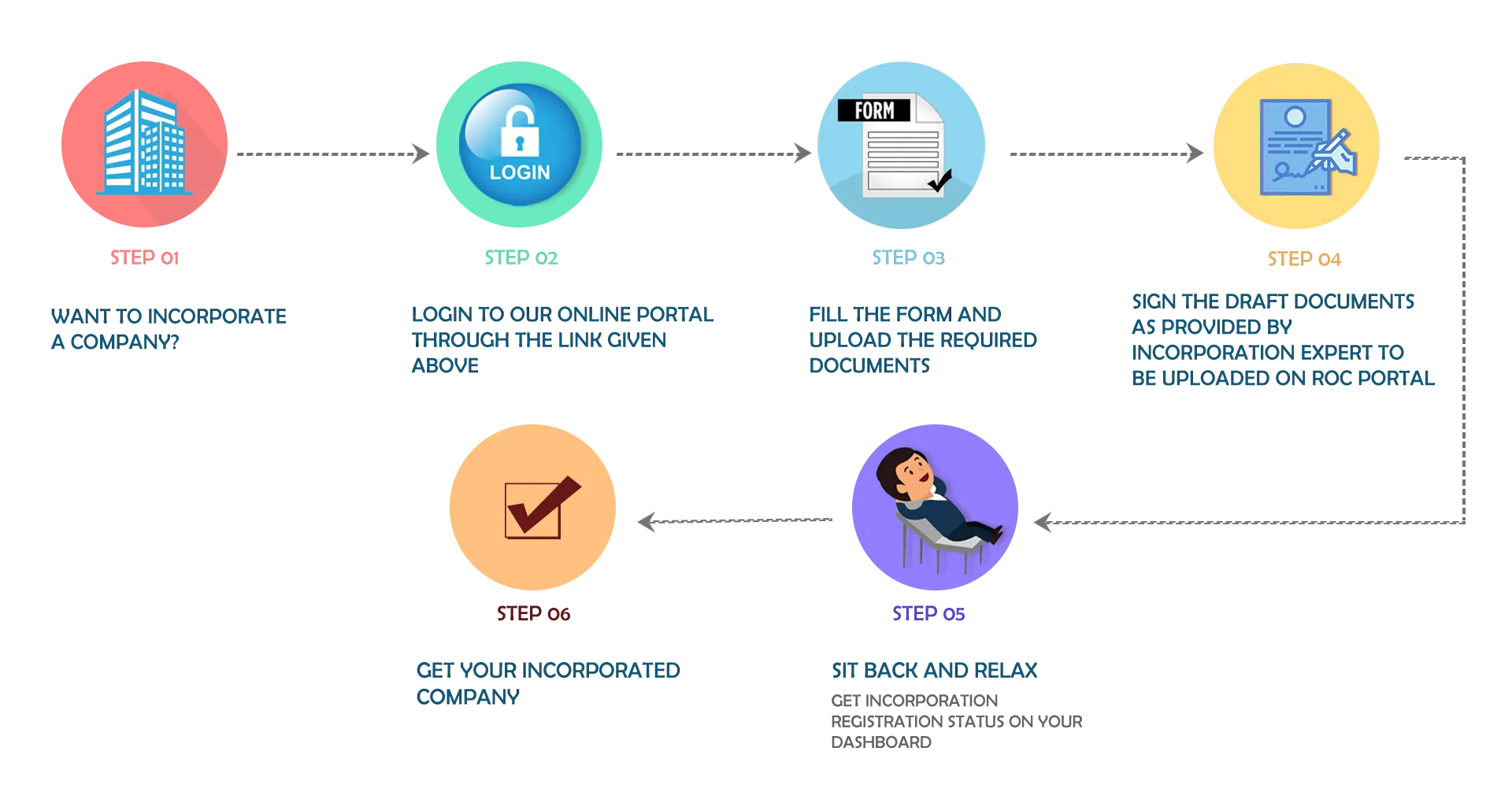

HOW WE WORK

ADVANTAGES

Separate legal entity

A Public limited company has a separate legal entity. It owns the name, act under the name and has a seal of its own and its assets are sperate and distinct for those of its member.

Limited Liability

The privilege of limited liability for business debts is liability of a member as shareholder extends to the contribution to the capital of the company up to the nominal value of the shares held and not paid by him.

Free & Easy transferability of shares

Shares of a company limited by shares are transferable by a shareholder to any other person. Filing and signing a share transfer form and handing over the buyer of the shares along with share certificate can easily transfer shares.

Perpetual succession

The life of the Company is not dependent on the life of its founders or its members. Even if the members, for that matter even all members, become bankrupt/insolvent, the company remains unaffected.

Borrowing Capacity

A company can issue debentures, secured as well as unsecured and can also accept deposits from the public, etc. Even banking and financial institutions prefer to render large financial assistance to a company rather than partnership firms or proprietary concerns.

No restriction on number of members

Unlike private limited company, there is no restriction on the public limited company related to maximum number of members.

FREQUENTLY ASKED QUESTIONS

Whether Companies are required to make payment of Stamp Duty in case of incorporation of Company with authorized Capital of Rs. 10 Lakh or below?

Yes, Company has to pay the Stamp Duty. Because Stamp Duty is state matter. Companies Act, has given exemptions for the ROC fees not for the stamp duty.

WHY CHOOSE SUPERCA

12 ways we make tax compliance hassle-free and enjoyable for you!

Contactless service

We are Tax Saviour

We offer Free Trial Service

We Promise Accuracy

We File Timely Return

Hassle Free Filing

We keep your data confidential

We offer One Stop Solution

No Hidden Charge

Money Back Guarantee

Dedicated Support