GST Composition

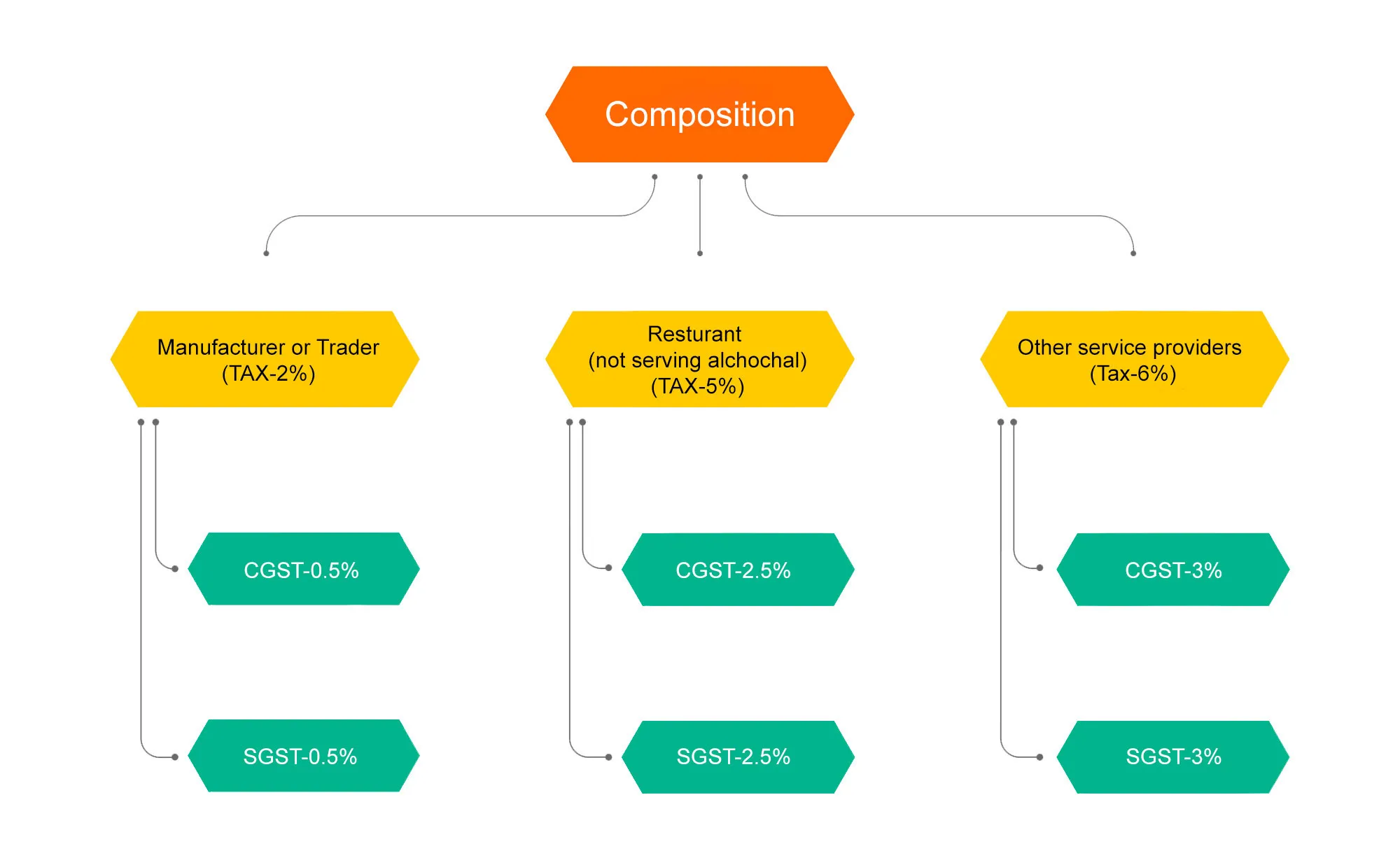

Composition Scheme is a simple and easy scheme under GST for taxpayers. Small taxpayers can get rid of tedious GST formalities and pay GST at a fixed rate of turnover. This scheme can be opted by any taxpayer whose turnover is less than Rs. 1.5 crore*

Swift Swift |

Professional Professional |

Precise Precise |

One Stop One Stop |

GST COMPOSITION

First of all it is important to note that all the registered dealers are required to file GST Returns irrespective of the type of business or turnover or profitability during the return filing period. Under GST Regime, even a dormant business that has obtained GST registration must file GST return. Further, while running a business, maintaining books of accounts is essential. The Tax Department needs them, the bank or your investor might ask for them. Outsource your bookkeeping function and let professionals manage your business financial reporting. Bookkeeping is the process of recording financial transactions of a business in an accounting system and the creation of reports. As per section 128 of companies act 2013 read with related rules prescribed there under, every company is required to prepare and keep books of accounts at its registered office of the company. However, many small businesses do not have complete accounting departments and require external bookkeeping services. Realizing the need of the entrepreneurs, the plans are designed to provide all these services under one roof. These services (Book Keeping and GST filing) are bundled to give peace of mind to the entrepreneur so that the entrepreneur can focus on the core competences of the business and take the business to the next heights. The plans under this service are designed keeping in mind the paying capacity of the entrepreneur. The entrepreneur can choose a plan according to the turnover expected in a year. We assure you the flexibility in choosing a plan on monthly basis will not be provided by any services provider.

The dealer with the turnover of upto Rs. 1.5 crores can be registered under Composition Levy. However, casual taxable person and non-resident taxable persons cannot get registered under Composition Levy irrespective of their turnover. In case of North-Eastern states and Himachal Pradesh, the limit is Rs 75* lakh.

GST COMPOSITION

First of all it is important to note that all the registered dealers are required to file GST Returns irrespective of the type of business or turnover or profitability during the return filing period. Under GST Regime, even a dormant business that has obtained GST registration must file GST return. Further, while running a business, maintaining books of accounts is essential. The Tax Department needs them, the bank or your investor might ask for them. Outsource your bookkeeping function and let professionals manage your business financial reporting.

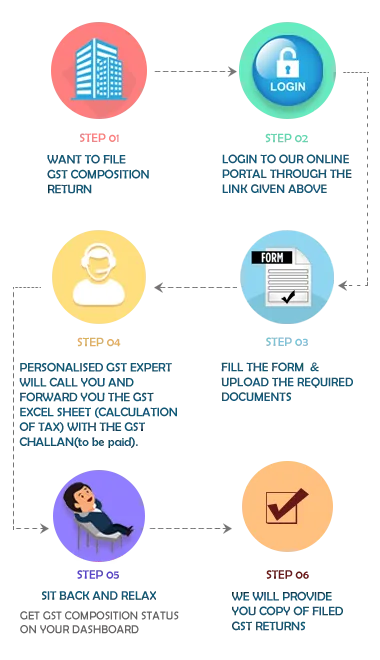

Read MoreHOW WE WORK

ADVANTAGES

No need for accountant

To file the GST Composition Return the entrepreneur does not have to appoint the accountant or need to maintain the books. The entrepreneur just have to provide the sales bills on Super CA portal, the experts will prepare the GST return.

All records in excel

Since there is no need to maintain the books of accounts for the entrepreneur registered under GST Composition Scheme, at Super CA we maintain all your sale data in excel at no extra cost.

Less complicated

As all the records are maintained in excel, it become very easy for a entrepreneur to read/ study the excel and determine the quantum of sales in a month/quarter/ year. Moreover, the GST Expert will also help the entrepreneur to understand such as sheet.

COST SAVING

Since there is no requirement to maintain books of accounts and Super Ca provides composition registered entrepreneur the facility to maintain the sales record in excel at no extra cost, this helps the entrepreneurs in saving the huge cost.

Flexibility

The entrepreneur can migrate from composition to normal dealer in GST anytime after the end of a financial year.

High liquidity

Since the tax rates are comparatively low in case of composition dealer, this ensures high liquidity.

Choose Your Plan

₹500+GST

SALES RECORDS IN EXCEL

PERSONAL GST ACCOUNTANT(FOR EXCEL)

GST EXPERT

GST-CMP-08

PHONE/EMAIL/CHAT

GST PAYMENT SUPPORT

GSTR-9A

GET THIS PLAN @ ₹ 500/- P.M. PLUS GST

₹1250+GST

BOOK KEEPING

PERSONAL GST ACCOUNTANT(FOR EXCEL)

GST EXPERT

GST-CMP-08

PHONE/EMAIL/CHAT

GST PAYMENT SUPPORT

GSTR-9A

LEDGER ACCOUNTS

ACC. RECONCILIATION

BANK RECONCILIATION

ACCOUNTS RECEIVABLE/PAYABLE

GST THIS PLAN @ ₹ 1250/- P.M. PLUS GST

FREQUENTLY ASKED QUESTIONS

WHY CHOOSE SUPERCA

12 ways we make tax compliance hassle-free and enjoyable for you!

Contactless service

We are Tax Saviour

We offer Free Trial Service

We Promise Accuracy

We File Timely Return

Hassle Free Filing

We keep your data confidential

We offer One Stop Solution

No Hidden Charge

Money Back Guarantee

Dedicated Support