ESIC Registration

ESI stands for Employee State Insurance managed by the Employee State Insurance Corporation which is an autonomous body created by the law under the Ministry of Labour and Employment, Government of India

Swift Swift |

Professional Professional |

Precise Precise |

One Stop One Stop |

ESIC REGISTRATION

Employee State Insurance Corporation is an autonomous body created by an act of Parliament under the Ministry of Labour and Employment, Government of India.

This scheme is for Indian workers who are provided with a huge variety of medical, monetary and other benefits from the employer. Any Company having more than 10 employees) who have a maximum salary of RS.21000 has to mandatorily register itself with the ESIC.

Further in the press conference held on 14.05.2020 finance minister has highlighted the following provisions of labor law code foe expansion of ESI coverage for benefit of workers:-

1. Extension of ESIC coverage pan- India to all districts and all establishments employing 10 or more employees as against those in notified districts/ area only.

2. Extension of ESIC coverage to employees working in establishment with less than 10 enployees on voluntary basis.

3. Mandatory ESIC coverage through notification by central government for employees in hardazous industries with less than 10 employees.

ESIC registration

As per the government notification under Sec 1(5) of the ESI Act the following entities are required to be registered with ESIC:

1. Shops

2. Restaurants or Hotels only engaged in sales.

3. Cinemas

4. Road Motor Transport Establishments

5. Newspaper establishments (which is not covered under the factory act)

6. Private Educational Institutions

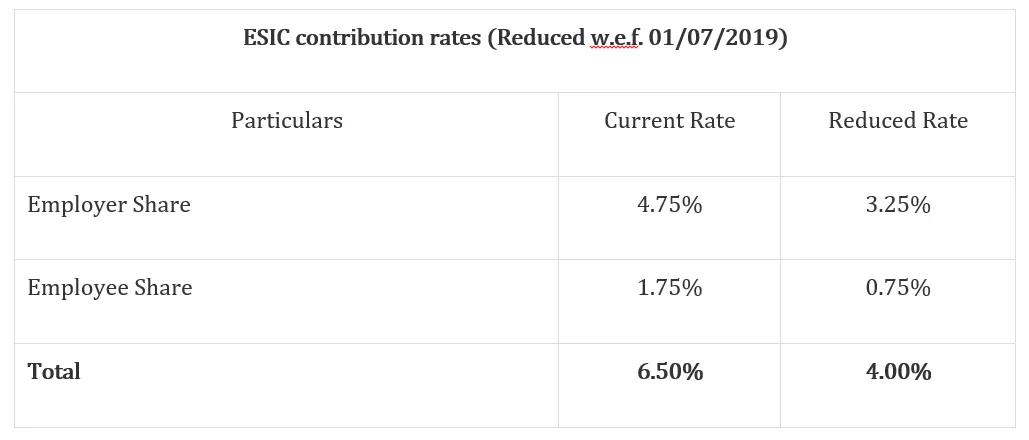

RATE OF CONTRIBUTION

ESIC REGISTRATION

Employee State Insurance Corporation is an autonomous body created by an act of Parliament under the Ministry of Labour and Employment, Government of India.

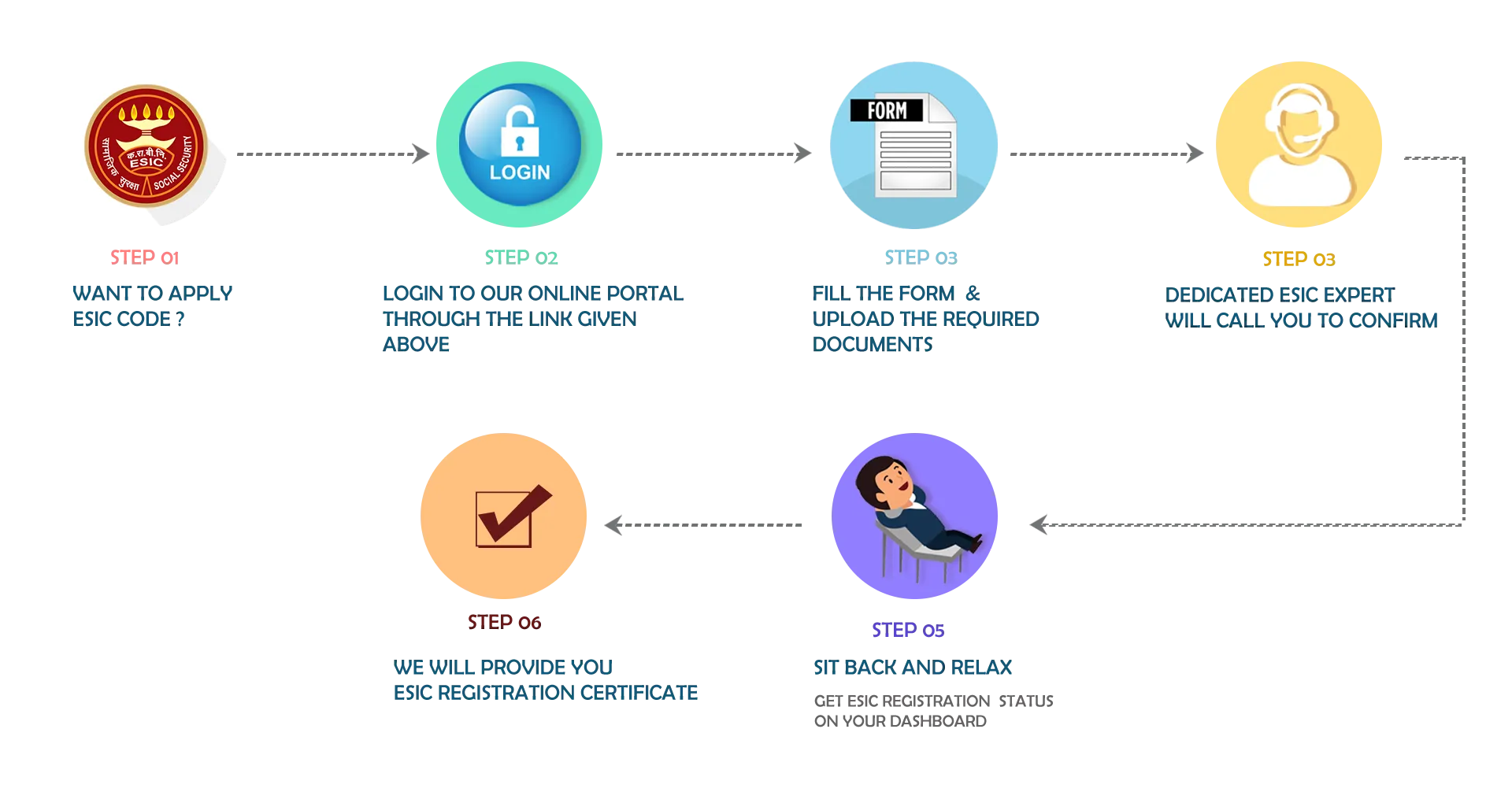

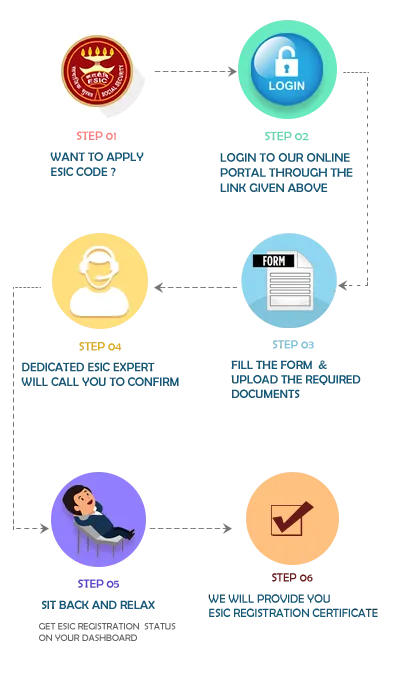

Read MoreHOW WE WORK

ADVANTAGES

For Employees

Protection against sickness

Sickness benefits at the rate of 70% (in the form of salary), in case of any certified illness certified and which lasts for a maximum of 91 days in any year

Medical Benefits

Medical benefits are given to the insured person & their family members (in some cases). These medical benefits are given in the form of patient treatment or attendance in the hospital or dispensary, clinic or other institution.

Pregnancy & Maternity Benefit

Maternity Benefit for confinement/pregnancy for Twenty Six weeks, which is extendable by further one month on medical advice at the rate of full wage.

After death benefits

If the death of the employee happens while on work – 90% of the salary is given to his dependents every month after the death of the employee. Funeral expenses are also given to the family.

Disablement benefits

In case of disability of the employee for not less than 3 days shall be entitled to the benefits under this scheme.

For Employers:

Protection against uncertainties

The employer has to just make a contribution of 3.25% and in return the employer will get compensation for work related accident and disability.

Focus on core competence of the business

Since the protection against the work related accidents and disabilities are provided by the scheme. Employers can just focus on the betterment of their organization without worrying about uncertainties.

To discharge legal liability

Getting an ESI Registration for the industrial unit/ organization is the legal liability of the employer under the Section 2A of the ESI Act 1948, read with the Regulation 10-B of the same Act. The ESIC Registration has to be obtained within 10 days from the date of commencement of operations at the industrial unit/organization.

To cover risk

The most primary advantage of the ESIC registration is that you can cover the monetary risks of your employees along with their dependents that might occur owing to ill-health or their decease.

To save interest

As per the Act, if the contribution by the employer is not deposited within the stipulated time, then an interest of 12% p.a. is levied.

Choose Your Plan

₹3999+GST

EPF CODE

1ST MONTH CALL/EMAIL SUPPORT

1ST MONTH EMAIL SUPPORT OF ALL NOTIFICATIONS

DEDICATED EPF EXPERT FOR 1ST MONTH

CLASS 2 DIGITAL SIGNATURE (WITH 2 YEARS VALIDITY)

GET THIS PLAN @ ₹3999 PLUS GST

₹6999+GST

EPF CODE

ESI CODE

1ST MONTH CALL/ EMAIL SUPPORT

1 ST MONTH EMAIL SUPPORT OF ALL NOTIFICATIONS

DEDICATED EPF EXPERT FOR 1ST MONTH

CLASS 2 DIGITAL SIGNATURE (WITH 2 YEARS VALIDITY)

GET THIS PLAN @ ₹6999 PLUS GST

₹8999+GST

EPF CODE

ESI CODE

3 MONTHS CALL/ EMAIL SUPPORT

3 MONTHS EMAIL SUPPORT OF ALL NOTIFICATIONS

DEDICATED EPF EXPERT FOR 3 MONTHS

1ST QUARTER CHALLAN PAYMENT SUPPORT

CLASS 2 DIGITAL SIGNATURE (WITH 2 YEARS VALIDITY)

GET THIS PLAN @ ₹8999 PLUS GST

FREQUENTLY ASKED QUESTIONS

For ESI compliance the employer has to maintain following records:

1. Muster roll, wage record and books of Account maintained under other laws.

2. Accident Register in new Form-11 and

3. An inspection book.

4. The immediate employer is also required to maintain the Employees’ Register for the employees deployed to the principal employer.

After the registration, ESI Returns have to be filed twice a year. You can avail our return filing services for simplifications of all these tasks. The following documents are required for the filing of the returns:

1. Register of Attendance of the Employees

2. Form 6 – Register

3. Register of wages

4. Register of any accidents which have happened on the premises of the business

5. Monthly returns and challans

WHY CHOOSE SUPERCA

12 ways we make tax compliance hassle-free and enjoyable for you!

Contactless service

We are Tax Saviour

We offer Free Trial Service

We Promise Accuracy

We File Timely Return

Hassle Free Filing

We keep your data confidential

We offer One Stop Solution

No Hidden Charge

Money Back Guarantee

Dedicated Support