Income Tax Savior Plans

Any Indian citizen between the age of 18 and 60 years can invest in NPS and avail this tax benefit. Even NRI can claim this benefit.

Swift Swift |

Professional Professional |

Precise Precise |

One Stop One Stop |

Income Tax Savior Plans

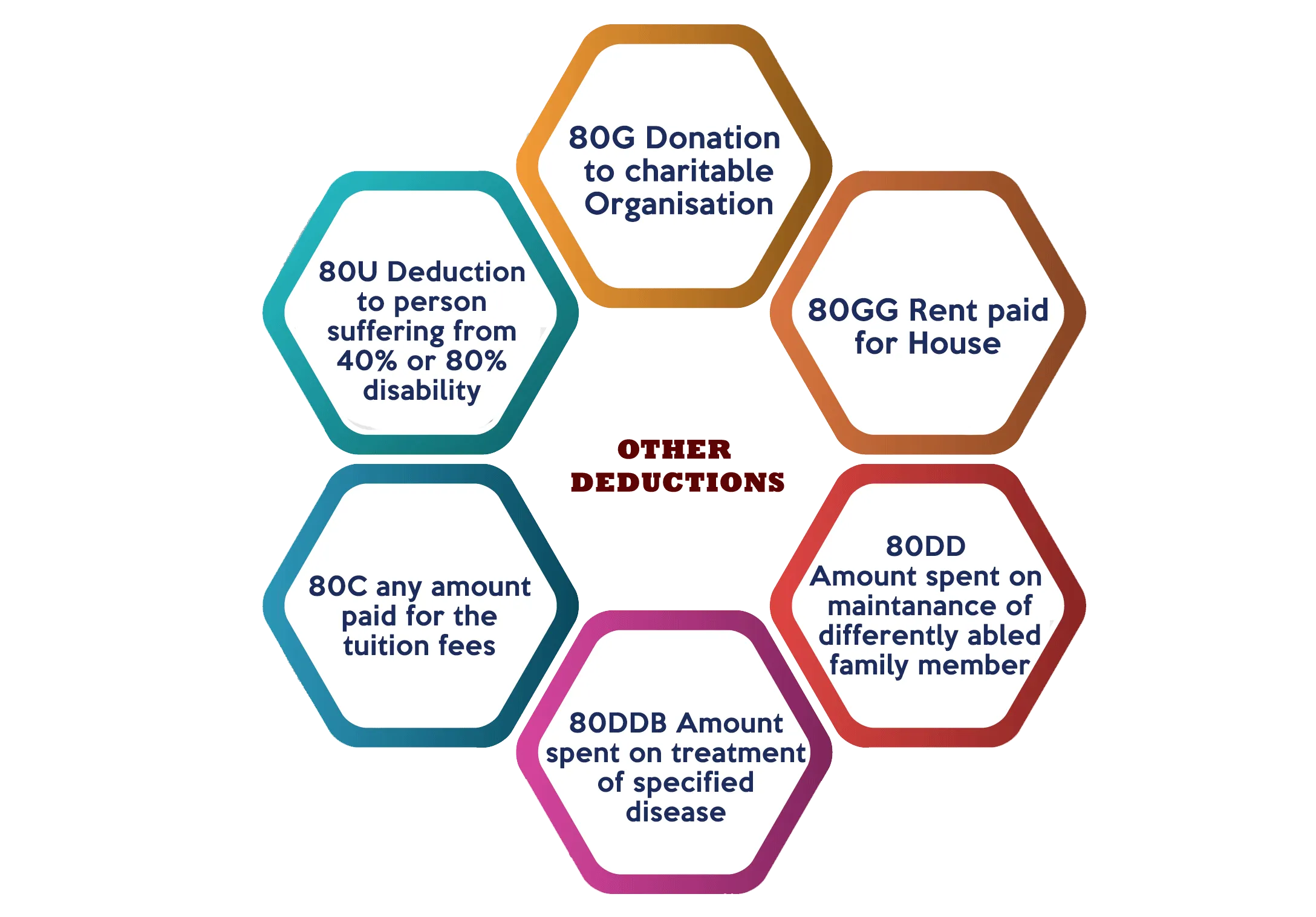

The Income Tax Act, 1961 provide various deductions under Section 80. These deductions can be claimed by the taxpayer to lower down the tax liability. These deductions can be divided in to two parts, namely general deductions and personal deductions. These deductions can be elaborated as:

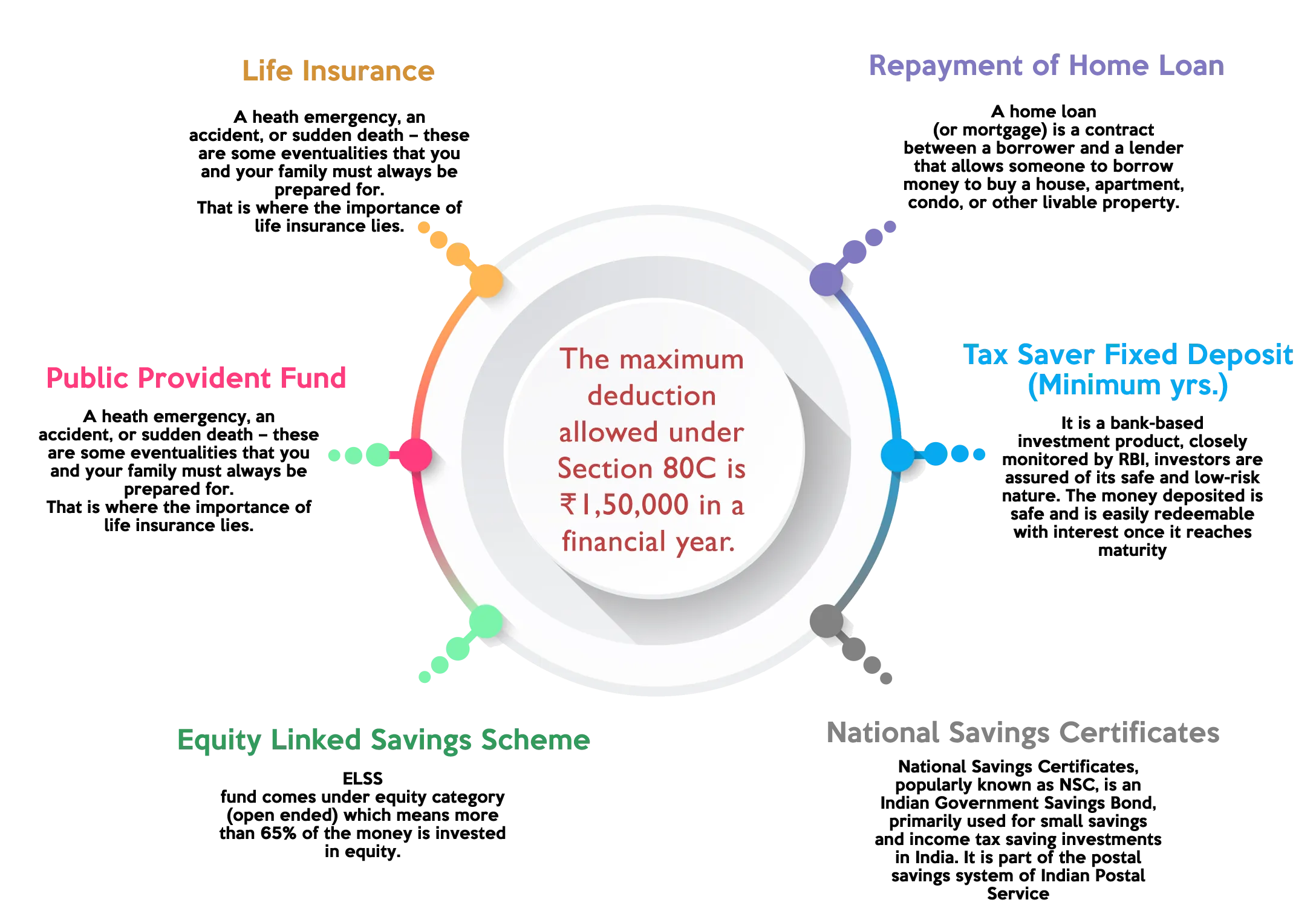

1. Section 80C

A taxpayer can claim deduction for any payment made towards

Super CA, helps you to choose the best type of investment under 80C based on the needs of the taxpayer. Once the type is chosen by the taxpayer, then our team of experts will help you to choose the best option under such type.

2. Section 80CCD

Section 80CCD discusses the tax deductions available to taxpayers regarding the investments in National Pension System (NPS). There are two subsections here:

- • Section 80CCD (1):

- • Section 80CCD (1b):

Investments in NPS are eligible for tax deductions under this section. Any Indian citizen between the age of 18 and 60 years can invest in NPS and avail this tax benefit. Even NRI can claim this benefit. The maximum deduction you can avail under this section is 10% of your salary (this includes basic salary + DA). For self-employed individuals, the limit is 20% of their gross total income. Also, the maximum benefit you can avail every year under this section is ₹1.5 lakh.

This subsection provides an additional deduction of ₹50,000 on investments in NPS. This is over and above the ₹1.5 lakh available under Section 80CCD (1). So, in short, you can avail a total tax deduction of ₹2 lakh when you invest in NPS every year.

WHAT IS NPS?

As the name suggests NPS is the way to secure continue cash flows after retirement. Any Indian citizen between 18 and 60 years can join NPS. A taxpayer have to contribute a minimum of Rs 6,000 in a financial year. The money invested in NPS is managed by PFRDA-registered Pension Fund Managers. Super CA, will assist you and provide you with an expert who will provide real time information with regard to such fund.

3.Section 80D

Under Section 80D of the Income Tax Act, you can claim deductions up to ₹1 lakh for contributions towards medical insurance premiums bought for insuring self, spouse, children and parents. The deductions under 80D are over and above exemptions you can claim under Section 80C. This benefit can be claimed by individuals and Hindu Undivided Families (HUFs). Spends on preventive health care is also eligible for deduction under section 80D with a maximum cap of ₹5,000/- for self or family and ₹7,000/- for parents.

What is Mediclaim?

Mediclaim policy offers hospitalisation benefit if the policyholder is admitted to a hospital for treatment of sudden illness or injuries caused by an accident. Under the mediclaim policy, the insurer pays for expenses of hospitalisation or treatment in return of a premium which pays is monthly, quarterly, half yearly and yearly.

4. Section 80E

Under Section 80E of the Income Tax Act, the amount you spend in repaying the interest of your education loan can qualify as a deduction from your total income. The loan should have been taken for the education of self, spouse, children or a student for whom you are the legal guardian and should have been taken from a bank or an approved financial institution.

What is education loan?

Education loans are issued for the purpose of attending an academic institution and pursuing an academic degree. Education loans can be obtained from the government or through private-sector lending sources. Super CA, helps you to find education loan at lowest interest rates and easy repayment options.

5.Section 80EE-

Section 80EE of the Income Tax Act, 1961 allows a tax deduction benefit on the interest paid on home loans taken by a first-time homebuyer. If you fall in this category, you can claim a tax deduction up to ₹50,000 under section 80EE. This deduction limit is over and above the limit provided under section 80C and Section 24 of the IT Act, 1961.

What is home loan?

A home loan (or mortgage) is a contract between a borrower and a lender that allows someone to borrow money to buy a house, apartment, condo, or other liveable property. Super CA with the aim of providing al services under one roof will help a taxpayer in providing a home loan from various banks and NBFCs associated with us.

6.Section 80TTA

Section 80TTA allows you to claim a deduction of ₹10,000 on your interest income. This deduction is only available to individuals and HUFs. The deduction is allowed on:

- • The interest earned on a savings bank account.

- • The interest earned on a savings bank account with a co-operative society engaged in banking activities

- • The interest on a savings bank account with a post office

Income Tax Savior Plans

The Income Tax Act, 1961 provide various deductions under Section 80. These deductions can be claimed by the taxpayer to lower down the tax liability.

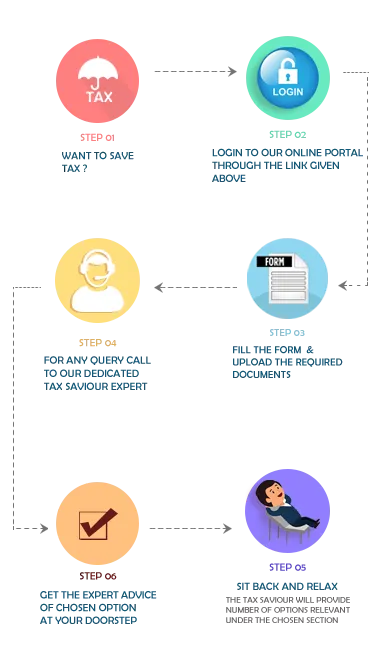

Read MoreHOW WE WORK

ADVANTAGES

Reduction in tax liabilities

A taxpayer can save his tax liabilities by saving in the plans/schemes allowed by the government.

Minimization of litigation

Since these schemes/plans are allowed by the government, the investment in plans is known as tax planning. The tool of tax planning is legal in India, so no question of litigation arises.

Productive investment

These plans/schemes are allowed in order to increase the investment by the taxpayer. These Investments generally grow and results in gains for the taxpayers.

Economic stability

These investments provide economic stability to the taxpayers, the taxpayer can use these investments to absorb the economic

Tax Planning

Books Keeping facilitates tax planning by proper recording of all transactions related to expenses, bank, salesand purchases etc.

Budget

Accountants may handle more advanced tasks like tax preparation, budget analysis, and investment development. Both Accountants and bookkeepers frequently use advanced financial software to record and track their information

FREQUENTLY ASKED QUESTIONS

1. I will manage you bookkeeping for you and take away your bookkeeping headaches forever!

2. I will accurately record all of your transactions and provide you with a "score card" report of sales, profits and cash on hand in a timely manner.

Best of all this can be done for about half of what a bookkeeper costs an employer! By providing accurate bookkeeping, I will help you focus on what works in your company. In every small business 20% of what you do generates 80% of the net profits. We all know the 80/20 Pareto principle-but almost none of us have actually implemented it in our business. I will help you get it done as part of our Outsourced Bookkeeping Service

Assets = Liabilities + Owners Equity.

There are three branches of accounting:

Financial Accounting

Management Accounting

Cost Accounting

WHY CHOOSE SUPERCA

12 ways we make tax compliance hassle-free and enjoyable for you!

Contactless service

We are Tax Saviour

We offer Free Trial Service

We Promise Accuracy

We File Timely Return

Hassle Free Filing

We keep your data confidential

We offer One Stop Solution

No Hidden Charge

Money Back Guarantee

Dedicated Support