Book Keeping

Bookkeeping is the systematic recording and organising of financial transactions in a company. Starting and maintaining solid, professional accounting practices is essential for the growth of a business.

Swift Swift |

Professional Professional |

Precise Precise |

One Stop One Stop |

BOOK KEEPING

While running a business, maintaining books of accounts is essential. The Tax Department needs them, the bank or your investor might ask for them. Outsource your bookkeeping function and let professionals manage your business financial reporting. Bookkeeping is the process of recording financial transactions of a business in an accounting system and the creation of reports. As per section 128 of companies act 2013 read with related rules prescribed there under, every company is required to prepare and keep books of accounts at its registered office of the company. However, many small businesses do not have complete accounting departments and require external bookkeeping services. Super CA can provide your business with bookkeeping services through a network of Business Experts and Chartered Accountants across India.

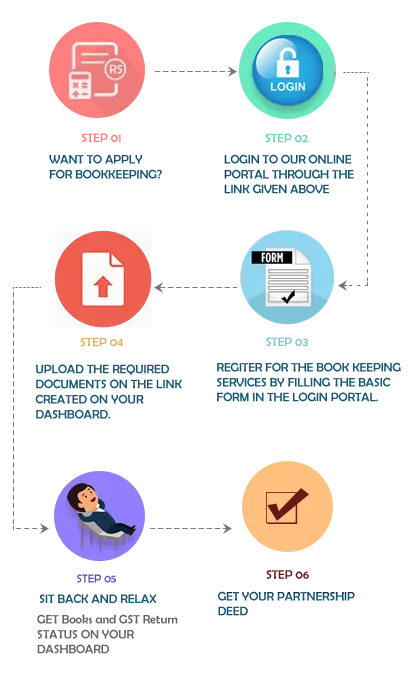

HOW WE WORK

ADVANTAGES

Bookkeeping services are necessary for all businesses to ensure accurate operational/financial information. Such information is required by Management, Regulators, and Investors. Following are given below few advantages

Cost Effective

By maintaining books of accounts, it is easy to ascertain cost of whole unit or per unit of product. Which ultimately leads to figure out where more money is expending or where we need to control?

Time Effective

By maintaining books of accounts, it is possible to ascertain exact profit or loss timely and to ensure that all relevant taxes are paid and tax filings are made on time.

Higher Profit

Profit can be triggered with the help of accounting. We may know time to time basis what needs to be done to ascertain correct profit.

Reduced Tax Liabilities

With the help of proper books of account it is easy to identify that each and every bill is entered or not, which ultimately lead us to correct tax summary.

Tax Planning

Books Keeping facilitates tax planning by proper recording of all transactions related to expenses, bank, salesand purchases etc.

Budget

Accountants may handle more advanced tasks like tax preparation, budget analysis, and investment development. Both Accountants and bookkeepers frequently use advanced financial software to record and track their information

Choose Your Plan

₹1500+GST

BOOK KEEPING

LEDGER ACCOUNTS

ACC. RECONCILIATION

BANK RECONCILIATION

ACCOUNTS RECEIVABLE/PAYABLE

PERSONAL GST ACCOUNTANT

GET THIS PLAN @ ₹1500 PLUS GST

₹2500+GST

BOOK KEEPING

LEDGER ACCOUNTS

ACC. RECONCILIATION

BANK RECONCILIATION

ACCOUNTS RECEIVABLE/PAYABLE

PERSONAL GST ACCOUNTANT

GET THIS PLAN @ ₹2500 PLUS GST

₹4500+GST

BOOK KEEPING

LEDGER ACCOUNTS

ACC. RECONCILIATION

BANK RECONCILIATION

ACCOUNTS RECEIVABLE/PAYABLE

PERSONAL GST ACCOUNTANT

INCOME TAX AUDIT ASSISTANCE

GET THIS PLAN @ ₹4500 PLUS GST

FREQUENTLY ASKED QUESTIONS

1. I will manage you bookkeeping for you and take away your bookkeeping headaches forever!

2. I will accurately record all of your transactions and provide you with a "score card" report of sales, profits and cash on hand in a timely manner.

Best of all this can be done for about half of what a bookkeeper costs an employer! By providing accurate bookkeeping, I will help you focus on what works in your company. In every small business 20% of what you do generates 80% of the net profits. We all know the 80/20 Pareto principle-but almost none of us have actually implemented it in our business. I will help you get it done as part of our Outsourced Bookkeeping Service

Assets = Liabilities + Owners Equity.

There are three branches of accounting:

Financial Accounting

Management Accounting

Cost Accounting

WHY CHOOSE SUPERCA

12 ways we make tax compliance hassle-free and enjoyable for you!

Contactless service

We are Tax Saviour

We offer Free Trial Service

We Promise Accuracy

We File Timely Return

Hassle Free Filing

We keep your data confidential

We offer One Stop Solution

No Hidden Charge

Money Back Guarantee

Dedicated Support