Gst Nil Filers

Nil return filers is a report to keep a check on Tax Payers not paying any Tax.

Swift Swift |

Professional Professional |

Precise Precise |

One Stop One Stop |

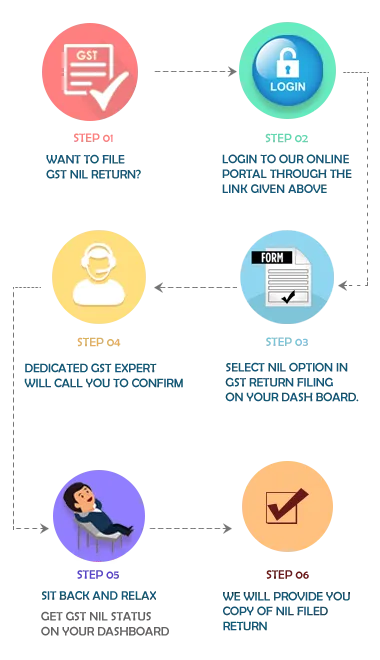

HOW WE WORK

ADVANTAGES

Timely compliance

All taxpayers having GST registration should file GST returns on time. Even if there was no business activity or transaction during a month, the taxpayer must still file NIL GST return to avoid penalty. Super CA helps you to file nil GST returns in no time.

No penalty

Nil GSTR-1 & GSTR-3B return must be filed by all regular taxpayers having GST registration even if there were no sales transaction in a month. If the taxpayer fails to file GSTR-3B return, a penalty of Rs.20 per day shall apply. By, subscribing to our plan a taxpayer can save upto Rs. 5000/- penalty every month.

Image building

The business entities having strong law compliance is always in the good books of the Government. We at Super CA help you to be a strong law compliance business entity.

CONTINUATION OF BUSINESS

In the months of no transactions in the business nil filling is important as non-filing of GST returns will result in cancellation of GST registration, which have adverse impact on the continuity of the business.

Opportunity

As, discussed above nil filing of return will help a taxpayer to maintain continuity of the business and a business entity will also have an opportunity to grow.

Choose Your Plan

₹350+GST

TIMELY FILING OF GSTR-3B

TIMELY FILING OF GSTR-1

DEDICATED GST EXPERT

ASSISTANCE ON EACH QUERY OF GST

GET THIS PLAN @ ₹ 250/- P.M. PLUS GST

FREQUENTLY ASKED QUESTIONS

WHY CHOOSE SUPERCA

12 ways we make tax compliance hassle-free and enjoyable for you!

Contactless service

We are Tax Saviour

We offer Free Trial Service

We Promise Accuracy

We File Timely Return

Hassle Free Filing

We keep your data confidential

We offer One Stop Solution

No Hidden Charge

Money Back Guarantee

Dedicated Support