EPF Registration

An Employee Provident Fund (EPF) is an initiative provided to offer social security to employees of an organization that helps in strengthening employee-employer bonds.

Swift Swift |

Professional Professional |

Precise Precise |

One Stop One Stop |

EPF REGISTRATION

Employees’ Provident Fund Organisation (EPFO) is a statutory body under the Ministry of Labour & Employment, Government of India which has been established by an act of parliament, namely Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

The Employees’ Provident Fund and Miscellaneous Provisions Act 1952 applies to the Factories engaged in Industries specified in Schedule I of the Act or to other establishments notified and engaging 20 or more employees. All such eligible establishments are mandatorily required to abide by the rules and regulations of EPFO for remitting contribution in provident fund, pension fund and deposit linked insurance fund.

EPF registration

Registration for EPFO is compulsory for new companies and the companies / establishments which employ more than 20 individuals. Also, small establishments which do not have the minimum strength can register themselves voluntarily. Establishments which grow to strength of 20 employees are expected to register themselves within 15 days of attaining the minimum strength. A 15 digit alpha-numeric EPF Code number is allotted on registration for the purpose of handling EPFO related matters.

With the SPICe+ form being effective, EPF Registration and ESIC registration has now become mandatory for all the new companies that are to be incorporated through SPICe+

EPF REGISTRATION

Employees’ Provident Fund Organisation (EPFO) is a statutory body under the Ministry of Labour & Employment, Government of India which has been established by an act of parliament, namely Employees’ Provident Fund and Miscellaneous Provisions Act, 1952.

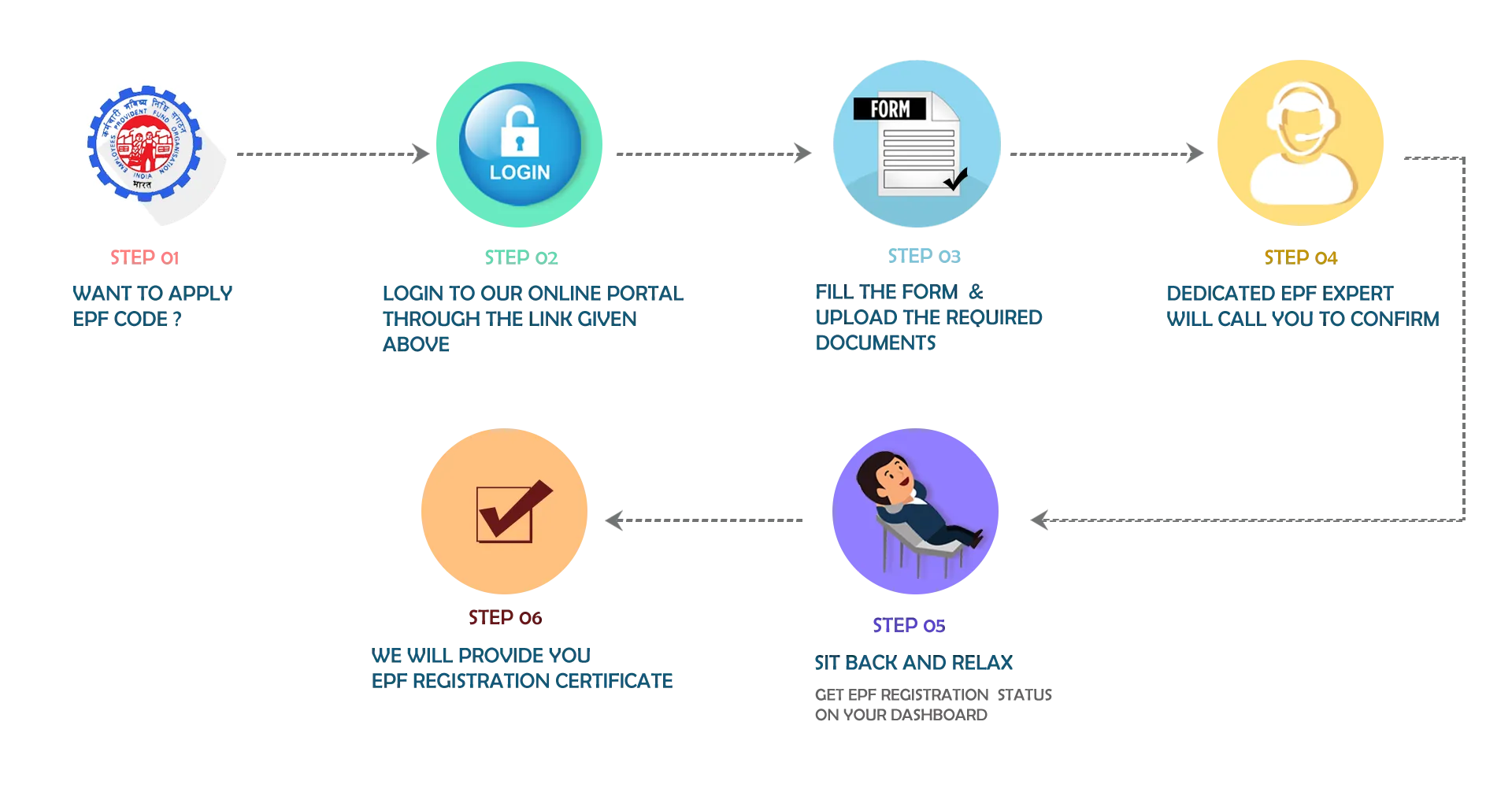

Read MoreHOW WE WORK

ADVANTAGES

To avoid penalty

If an employer does not get PF registration, if required to do so, or tries to escape PF payment, he will have to pay a penalty of INR 5,000/- or he may face imprisonment upto 1 year.

To cover risk

The most primary advantage of the EPF registration is that you can cover the monetary risks of your employees along with their dependents that might occur owing to untimely death, retirement etc.

Pension cover

Employee contributes 12 % of his salary towards EPF and the employer contributes the same amount which is bifurcated into 2 parts – 3.67% goes into EPF kitty and remaining 8.33% goes into Pension Fund through which the member will receive superannuation monthly pension or his family (widow and 2 children upto age of 25 years) will get the family pension after his demise.

Welfare of the society

The business uses the resources of the society, by contributing to the welfare of the employees; the employer is able to contribute to the general welfare of the society as whole.

Image building

The EPF compliant company has a great image in the eyes of the department as well as its clients.

Choose Your Plan

₹3999+GST

EPF CODE

1ST MONTH CALL/EMAIL SUPPORT

1 ST MONTH EMAIL SUPPORT OF ALL NOTIFICATIONS

DEDICATED EPF EXPERT FOR 1ST MONTH

CLASS 2 DIGITAL SIGNATURE (WITH 2 YEARS VALIDITY)

GET THIS PLAN @ ₹3999 PLUS GST

₹6999+GST

EPF CODE

ESI CODE

1ST MONTH CALL/ EMAIL SUPPORT

1 ST MONTH EMAIL SUPPORT OF ALL NOTIFICATIONS

DEDICATED EPF EXPERT FOR 1ST MONTH

CLASS 2 DIGITAL SIGNATURE (WITH 2 YEARS VALIDITY)

GET THIS PLAN @ ₹6999 PLUS GST

₹8999+GST

EPF CODE

ESI CODE

1 ST QUARTER CALL/ EMAIL SUPPORT

1 ST QUARTER EMAIL SUPPORT OF ALL NOTIFICATIONS

DEDICATED EPF EXPERT FOR 3 MONTHS

1 ST QUARTER ECR PAYMENT AND FILING SUPPORT

CLASS 2 DIGITAL SIGNATURE (WITH 2 YEARS VALIDITY)

GET THIS PLAN @ ₹ 8999 PLUS GST

FREQUENTLY ASKED QUESTIONS

EPF registration for the Employer will be obligatory if only:-

He runs a factory with 20 workers or more

Any other association/institution having 20 or more staff

The group of such associations for whom the Union Government may vide a notification would denote a necessary EPF registration.

Various compliance requirements of EPFO are to be met after completion of EPF registration. You will have to maintain EPF challan and regularly deposit the required amounts into the EPF accounts before 15th of the next month. You must add new employees into the EPF portal, generate their UANs and seed their KYC. You also have to fill out PF returns on regular basis.

WHY CHOOSE SUPERCA

12 ways we make tax compliance hassle-free and enjoyable for you!

Contactless service

We are Tax Saviour

We offer Free Trial Service

We Promise Accuracy

We File Timely Return

Hassle Free Filing

We keep your data confidential

We offer One Stop Solution

No Hidden Charge

Money Back Guarantee

Dedicated Support