Msme Registration

MSME stands for Micro, Small and Medium Enterprises. In a developing country like India, MSME industries are the backbone of the economy. ... These industries are also known as small-scale industries or SSI's.

Swift Swift |

Professional Professional |

Precise Precise |

One Stop One Stop |

MSME REGISTRATION

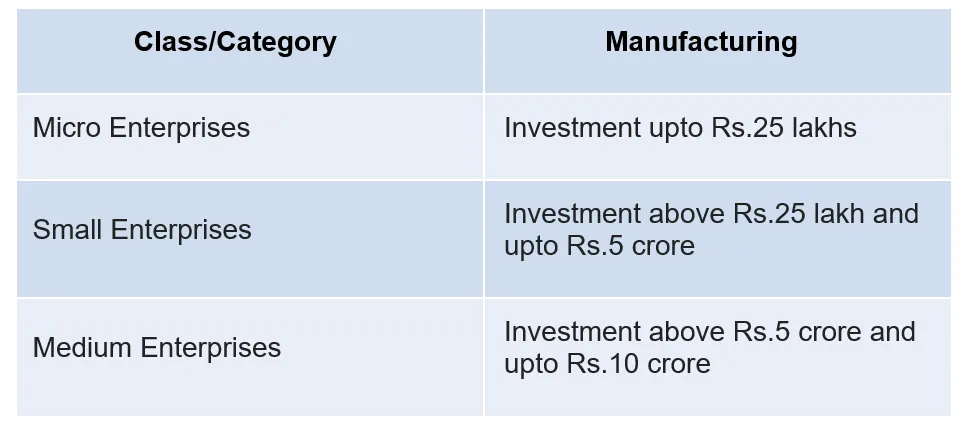

According to the government of India, the Micro, Small and medium enterprises Act, 2006 are defined as below:

In a micro enterprise, the investment done on machinery and plant ranges between 10 lakh to 25 lakh.

An enterprise where the investment on plant and machinery is over 25 lakh but does not exceed Rs. 5 crore, for small services between Rs. 10 lakh to Rs. 2 crore.

A medium enterprise is one where the investment in the plan and machinery is between Rs. 5 crore to Rs. 10 crore, for medium service between Rs. 2 crore to Rs. 5 crore.

The MSME plays important role in India’s legacy economic model. This sector is considered to be providing a huge number of jobs as well as a job creator in the rural areas.

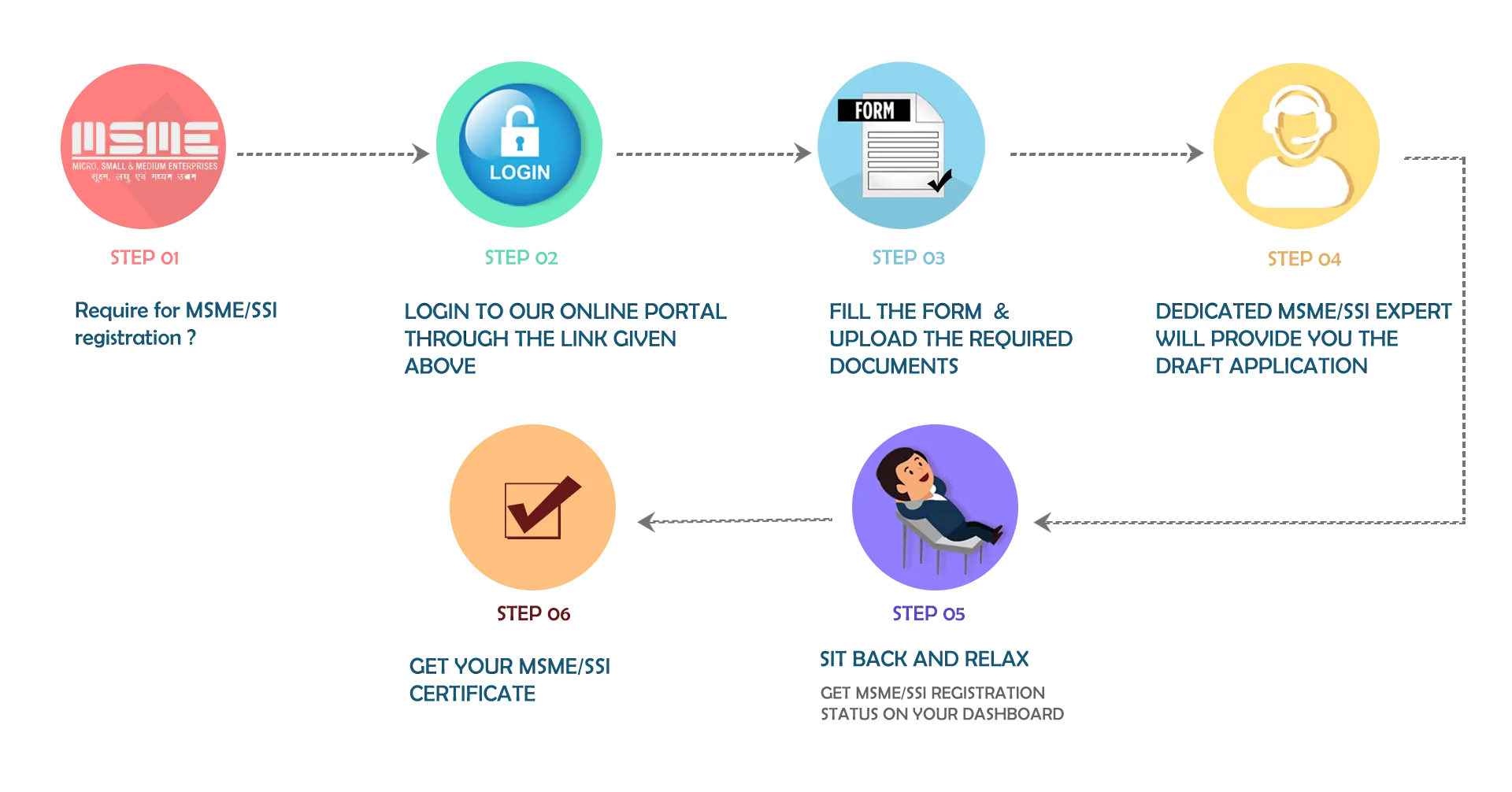

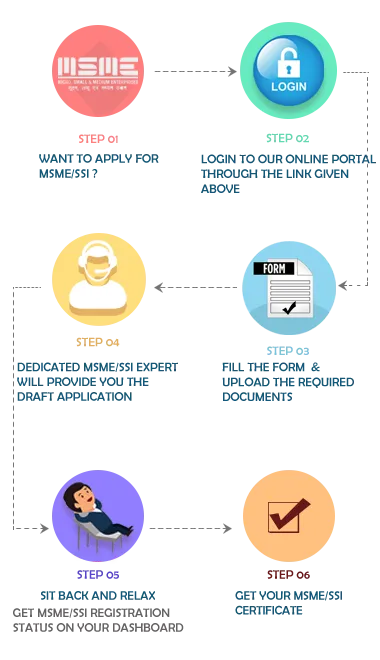

There is no mandatory mention of getting an online registration done for MSME done, but it is always suggested to get it done because of the various benefits it provides, such as the rate of interest charged would be relatively lower, capital investment subsides, tax subsidies and a lot of support from the government sector.

SUPER CA will assist you in getting your business an online registration for MSME to utilise benefits.

Type of MSME’S

There are 3 types of MSME or SSIs which can be classified as below:

MSME REGISTRATION

According to the government of India, the Micro, Small and medium enterprises Act, 2006 are defined as below:

In a micro enterprise, the investment done on machinery and plant ranges between 10 lakh to 25 lakh.

An enterprise where the investment on plant and machinery is over 25 lakh but does not exceed Rs. 5 crore, for small services between Rs. 10 lakh to Rs. 2 crore.