What is Cancelled Cheque and Its Consequences?

Many people and businesses feel lost when confronted with the plethora of banking jargon and instruments used in the financial sector. The phrase "cancelled cheque" is one example. At SuperCA, we know that this can be complex and overwhelming. That's why we're here to help demystify everything. In this blog, we are going to cover all the essential details you need to know. Additionally, we'll discuss the circumstances in which cancelling a cheque may be necessary, and the potential consequences on you and our business that may follow. You will be prepared to deal with any circumstance regarding a cancelled cheque after reading this blog post.

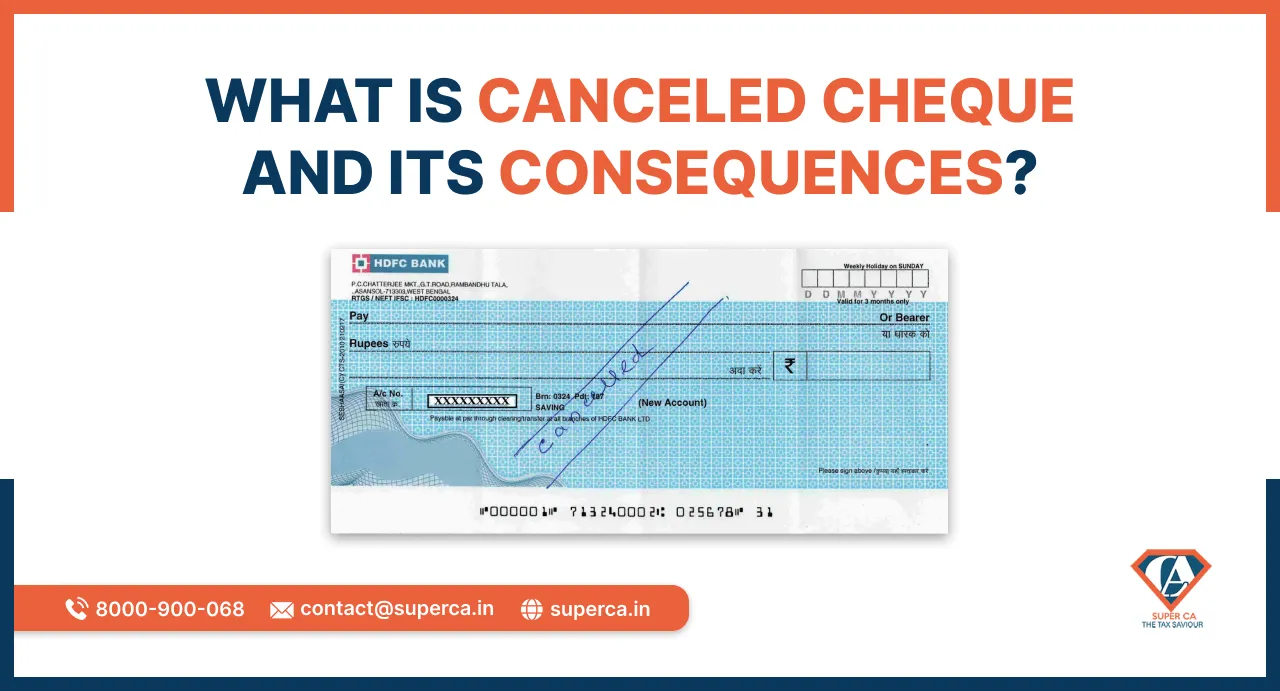

So, what exactly is a Cancelled cheque? A cancelled cheque is one that has been marked as null and void, either by the account holder or the bank, to prohibit its further usage. It cannot be utilized for any monetary withdrawals or other purposes. It's a standard tool for a wide range of commercial and monetary dealings, used primarily to reveal relevant banking information without exposing the recipient to fraud.

When it comes to cancelling a cheque, there are two main ways for the same to follow.

Having a copy of a cancelled cheque can be useful in a number of situations, both in business and in everyday life. Few usages are mentioned below -

If you're opening a new bank account or making changes to an existing one, the bank may ask to see a cancelled cheque as identification to confirm your name, account number and bank branch. This is a typical practice in the corporate world.

ECS is an electronic payment system that enables instantaneous payments transfer between bank accounts. This service is commonly used by businesses for wage payments and loan repayments. In order to sign up for ECS, you'll need a cancelled cheque, as it will contain the banking details you'll need.

Shares and other securities can be held electronically through the creation of a "Demat" account. The bank account linked to a Demat account must be validated with a cancelled cheque when opening an account so that dividends and other transactions can be processed.

A cancelled cheque is typically required when asking for a loan so that the lender can verify the account into which the funds will be deposited. This is the norm for all types of loans, including business financing.

Companies usually ask for a cancelled cheque when you want to withdraw your EPF money.

Organizations must follow KYC rules in order to prevent fraud, money laundering, and other criminal schemes. In order to validate the account holder's banking information, a cancelled cheque can be used as part of the Know Your Customer or KYC process.

Depending on the circumstances, cancelling a cheque might have both beneficial and detrimental effects on your company.

When talking about advantages, an important advantage of it is that it protects the recipient from potential fraud. You can prevent a canceled cheque from being used for withdrawals or other illegal purposes.

Businesses need to keep track of their finances. A cancelled cheque can document an attempted transaction that was ultimately unsuccessful, thereby facilitating the maintenance of openness and accountability in the company's financial dealings.

Cancelled checks can also serve as evidence of banking information for a number of reasons, including those already mentioned. This facilitates streamlined business processes and the proper dissemination of information.

Cancelling a cheque may also result in a negative impact on your credit score, especially if it is done frequently. A cheque is said to have bounced if it is cancelled after it has been issued and presented for payment. As a result, your company may face fines and have its credit rating lowered. Make sure the payee and the bank know about the cancellation in a timely manner to avoid this.

Secondly, cancelling a cheque can also incur fees or charges, depending on your bank's policies. Further, it may also cause inconvenience to payee. If a canceled cheque has already been issued, the recipient will have to wait for a new cheque or make other arrangements for payment. The relationship between you and your business associates may suffer as a result.

There may also be legal ramifications if a cancelled cheque is issued for no good cause. Payees who believe they are owed money from your company could sue if you dispute their claims. To minimize any confusion, make sure you have a good cause for cancellation and explain it to the payee.

It is crucial for organizations to comprehend what is cancelled cheque, how to cancel a cheque, and what its functions and repercussions are. There are a number of legal and reputational risks that can be avoided or mitigated if cancelled checks are managed correctly, including fraud prevention, accurate financial record-keeping, and regulatory compliance. Keeping these considerations in mind will allow you to make the most of canceled checks in supporting your company's financial activities and preserving its standing in the marketplace.

Further, it is true that using cancelled cheques for fraudulent activities is infrequent or rare, it's crucial to be careful when giving out financial documents containing sensitive information, including bank account and routing numbers. Such data may be exploited by individuals with malicious intentions to gain unauthorized access to your account or perpetrate fraud, and thus caution is necessary.

|

Essential LLP Registration Documents: A Complete Checklist for Entrepreneurs Author: Rahul Singh 04 Apr, 2024

|

Get inspired by these stories.