What is a TDS Certificate? Types of TDS Certificate

TDS stands for Tax Deducted at Source. It is a part of income tax and is deducted by an individual for some of the payments that they make. In this blog, we will go through the various provisions of TDS mentioned under the Income Tax Act.

TDS is the income tax that is reduced from the money that is paid while making some payments like rent, salary, interes, etc. It is obvious that a person who receives a salary has to pay income tax. However, the government ensures through TDS provisions that the deduction of income tax is done before you make any sort of payments. The receiver of the salary receives the income after the TDS has been reduced. The receiver adds the gross amount to his salary and the TDS is adjusted in his tax liability at the end. The credit for the amount that is deducted and paid goes to the individual.

Any individual who makes specific payments under the provisions of Income Tax Act has to deduct the Amount of TDS while making these payments. However, no such deduction needs to be done if the payments are being made by individuals or HUFs whose records do not need to be audited.

But if the payments made for rent by an individual or an HUFis more than Rs. 50000 per month, then they have to deduct a TDS at the rate of 5% even if he is not liable to perform a tax audit. Also, these individuals or HUFs do not have to apply for TAN. The employer has the power to deduct TDS at the rates of income tax slabs that are applicable, whereas a bank deducts a TDS at the rate of 10% and may raise it to 20% if your PAN is not present with the bank.

For most of the payments made by a person, the rates of TDS are already set under the provisions of Income Tax Act. TDS is deducted by the payer on the basis of the specified rates. In case you submit the proof of your investment in order to claim deductions and your total income that is liable for taxation is less than the taxable limit, then you will not have to pay any tax and no TDS will be deducted.

In the same way, a person can submit FOrm 15G and 15H in the bank if his total income is less than the specified taxable limit so that they stop the deductions of TDS on your interest income. However, if even after submitting all these proofs a deduction has been performed even when your income is less than the taxation limit, then a return and a claim can be filed to refund the amount deducted as TDS. A TDS or Tax Deducted at Source is deposited through Challan ITNS-281 by visiting the government portal.

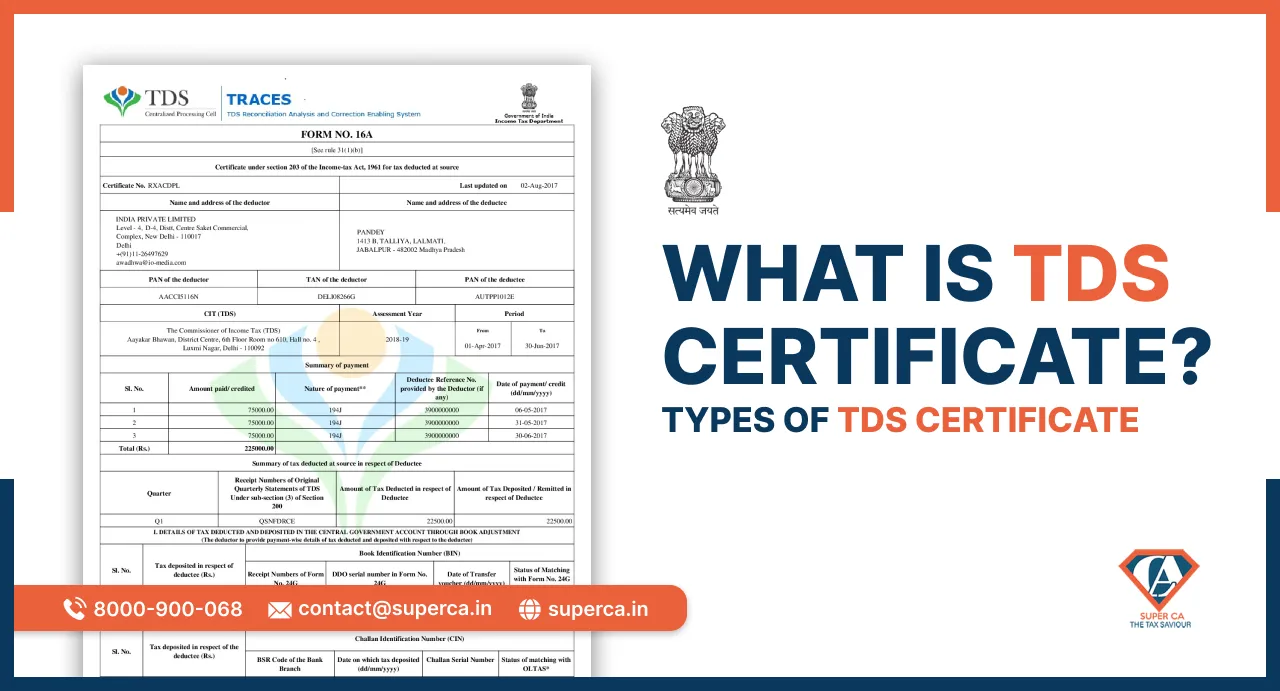

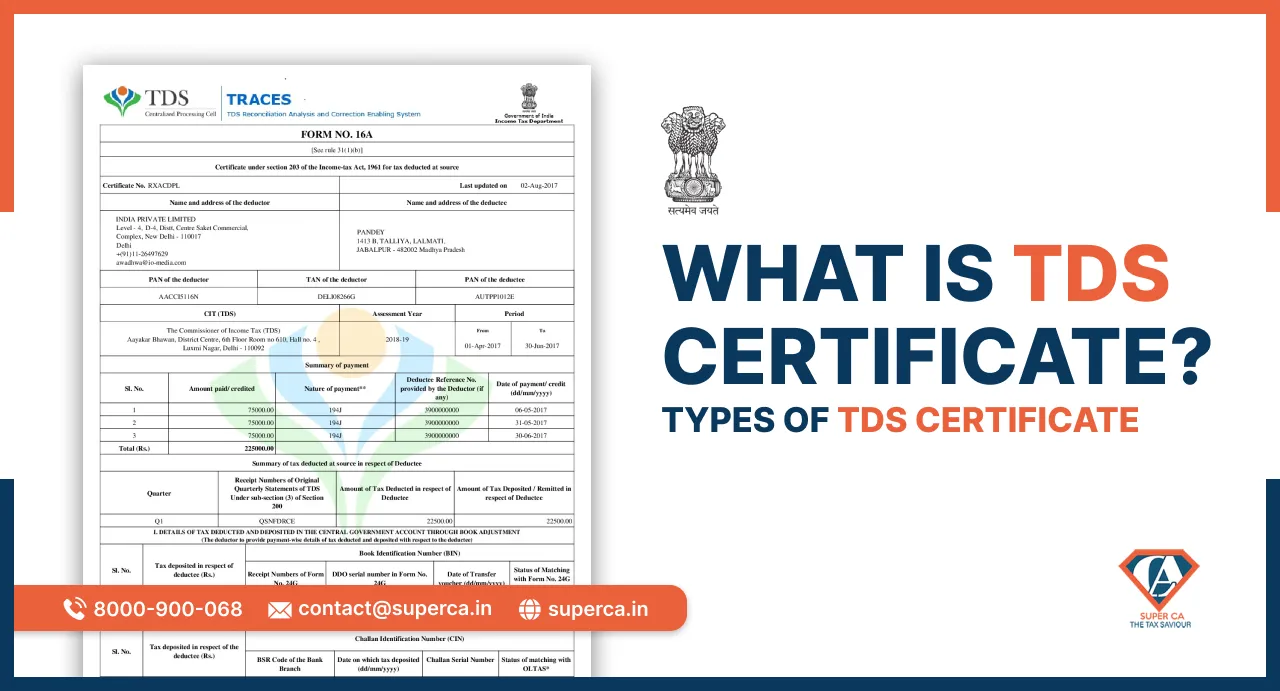

Form 16, 16 A, 16 B and 16 C are all examples of a TDS certificate. A TDS certificate is issued to an assessee from whose payment the TDS will be deducted and is issued by the person who is responsible for making the deduction. For example, a bank issues a Form 16A to someone who came to deposit when there is a TDS that is deducted from the fixed deposits. An employer issues Form 16 to his employee.

Form 16 is a certificate for the TDS that is deducted on salary and needs to be deducted on an annual basis. Form 16 A is a certificate for TDS that is deducted from non-salary payments and is deducted on a quarterly basis. Form 16 B is the TDS certificate for sale of property and is to be deducted on every transaction that an individual makes. Form 16C is the TDS certificate for payments of rent and will be deducted on every transaction.

In order to upload your TDS statements, you will have to follow the steps listed below:

The following are some of the sources of income that are eligible for the deduction of TDS:

TDS is deducted from the income on the basis of the tax slabs that apply to you. In all the other cases, TDS rates remain fixed and vary between 10% to 20%. However, the tax rates are not based on the income that you earn. Therefore, you may have to make TDS deductions in certain cases. Also, you will have to calculate your annual salary by combining your income from all the sources.

The actual liability to pay taxes is computed based on the total income that is liable for taxation. From the taxes that are being calculated, the credit for the TDS that is deducted on various receipts can be claimed. By reducing the TDS amount from the actual amount of tax that is liable for payment, the amount that needs to be paid to the income tax department can be calculated. It is also possible that you get a refund. However, in both the cases, you will have to file an ITR and pay the tax liability or may have to claim a refund.

|

Essential LLP Registration Documents: A Complete Checklist for Entrepreneurs Author: Rahul Singh 04 Apr, 2024

|

Get inspired by these stories.