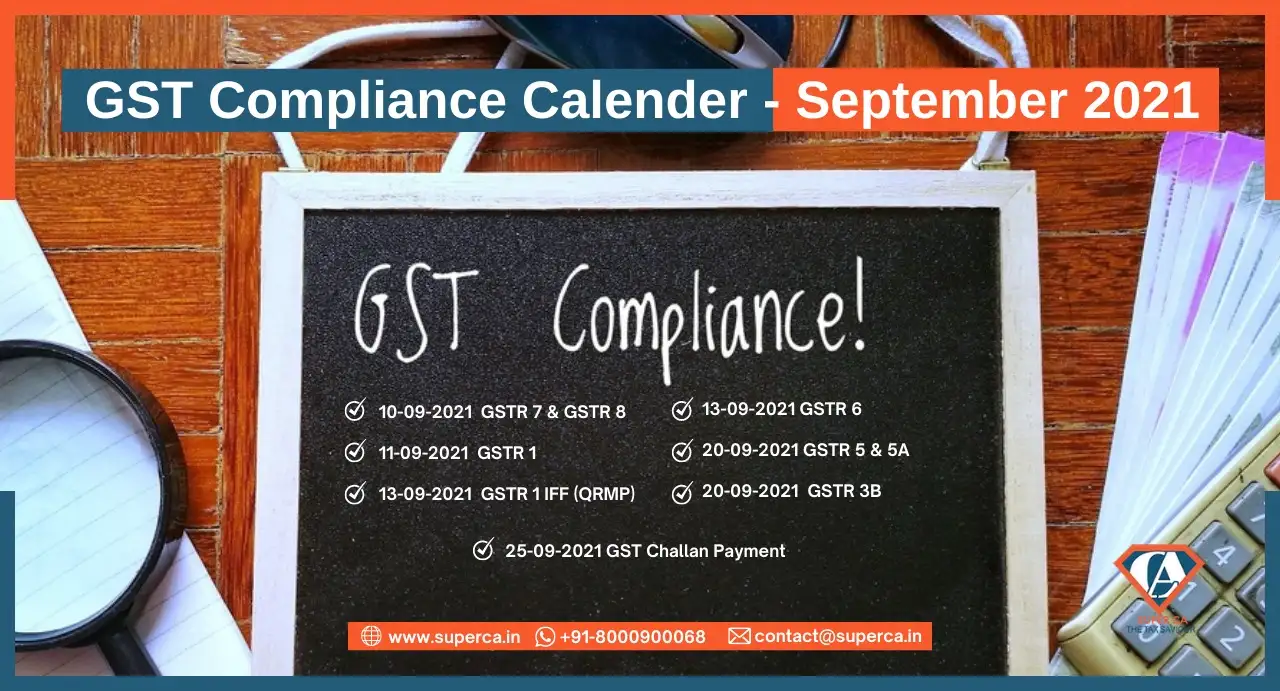

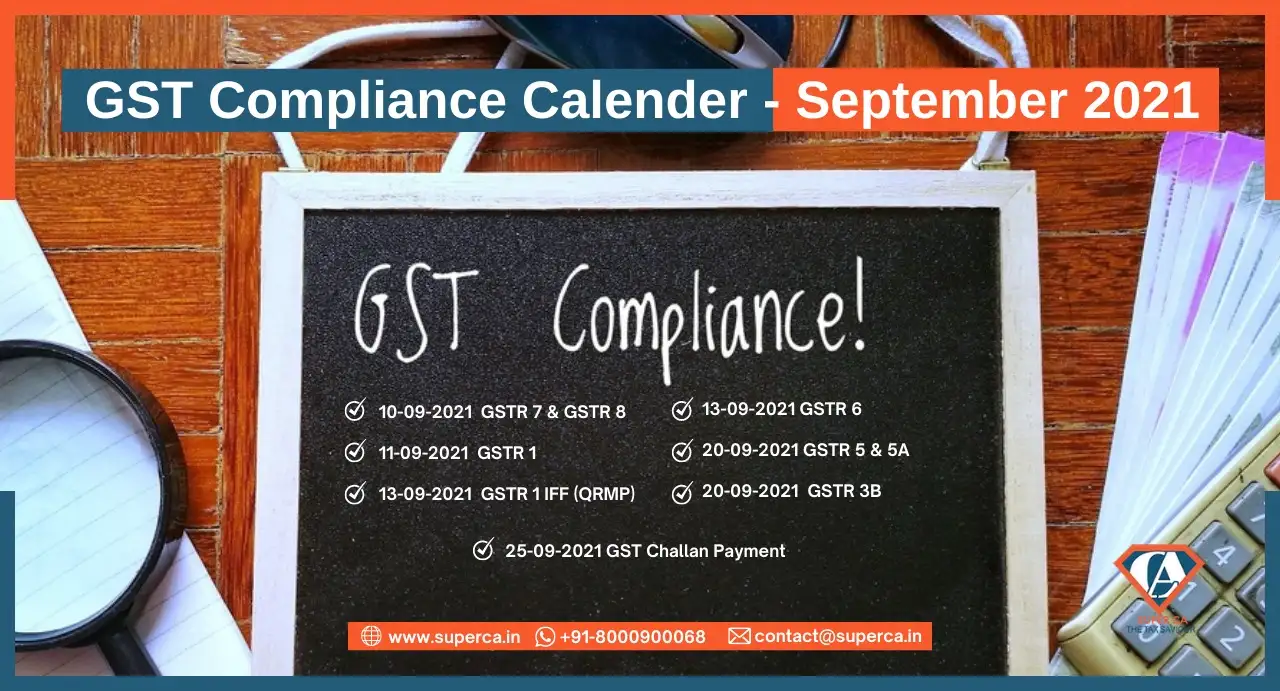

GST Compliance Calendar - September 2021

About

The half fiscal year completion has come on the scene by the arrival of September and there is a checklist of compliances that taxpayers need to follow before filing the September GST returns.

The due dates are very important for every taxpayer not only for sake of filing GST returns and prescribed forms under the GST law timely, but also to avoid incurring any interest or late fee.

It is also important for the businesses and entrepreneurs to stay compliant with various compliance throughout the year. Every month is significant, as far as GST compliance is concerned. There are various tax and statutory compliance that includes the due dates relating to GST return filings falls in the month of August 2021.

Regular compliances and procedures are required to be followed by those coming under its ambit. Now that the vaccination process in the country has speeded up and the government has lifted the Covid restrictions in most states, and the extension of due dates it seems very rare. Hence, from now onward, the taxpayers need to seriously look at their compliances. The GST registered dealer has to file a statement of the transactions of the business i.e. returns on a monthly/quarterly/annual basis.

|

|

|||

|

Due date |

Form |

Period |

Description |

|

10th September, 2021 |

GSTR 7 |

August 2021 |

➤ To be filed by registered taxpayers, who according to the GST ruling have to deduct tax at source. ➤ It consists of details of deducted TDS, TDS liability payable and paid and TDS refund claimed.

|

|

10th September, 2021

|

GSTR 8 |

August 2021 |

➤GSTR-8 return is filed by GST registered e-commerce operators who are required to deduct TCS under GST |

|

11th September, 2021 |

GSTR 1 |

August 2021 |

➤ Return to be furnished for reporting details of all outward supplies of goods and services made. ➤ For Taxpayers who have an aggregate turnover of more than Rs. 1.50 Crores or who has not opted for the QRMP scheme.

|

|

13th September, 2021 |

GSTR 1 IFF (QRMP) |

August 2021

|

For the taxpayers who opted for QRMP scheme (Optional) |

|

13th September, 2021 |

GSTR 6 |

August 2021 |

➤ It is a monthly input service distributor return which contains input tax credit information, acquired and distributed by the ISD. |

|

20th September, 2021 |

GSTR 5 & 5A |

August 2021 |

➤ For Non-Resident Taxpayers ➤ Contains all details of all outward/inward supplies, the period of return,credit or debit notes, cash ledger claim refunds, closing stock of goods, goods and services imported and any amendments in imports for preceding tax periods.

|

|

20th September, 2021 |

GSTR 3B |

August 2021 |

➤ It is a monthly self-declaration to be filed, for furnishing summarized details of all outward supplies made, input tax credit claimed, tax liability ascertained and taxes paid. It is filed by all taxpayers registered under GST. |

|

25th September, 2021 |

GST Challan Payment |

August 2021 |

GST Challan Payment if no sufficient ITC for Aug (for all Quarterly Filers) |

Cessation

It is very important for every business, irrespective of the business structure, to stay compliant with enormous compliance falling every month. But, once you follow all the GST compliance checklist, you will be able to conduct the business smoothly without any issues and concerns.

GST laws will not just reform your taxation but affect almost every aspect of your business operations. As a registered person, it is important to understand GST, its implications, and to adopt a robust system that will help alleviate GST compliance worries.

As far as compliances are concerned, September 2021 is a crucial month. Hence, taxpayers must ensure the filing of above mentioned forms on or before the due dates in order to save themselves from hefty penalties.

|

Essential LLP Registration Documents: A Complete Checklist for Entrepreneurs Author: Rahul Singh 04 Apr, 2024

|

Get inspired by these stories.