GST ARN Number! Generation and Status

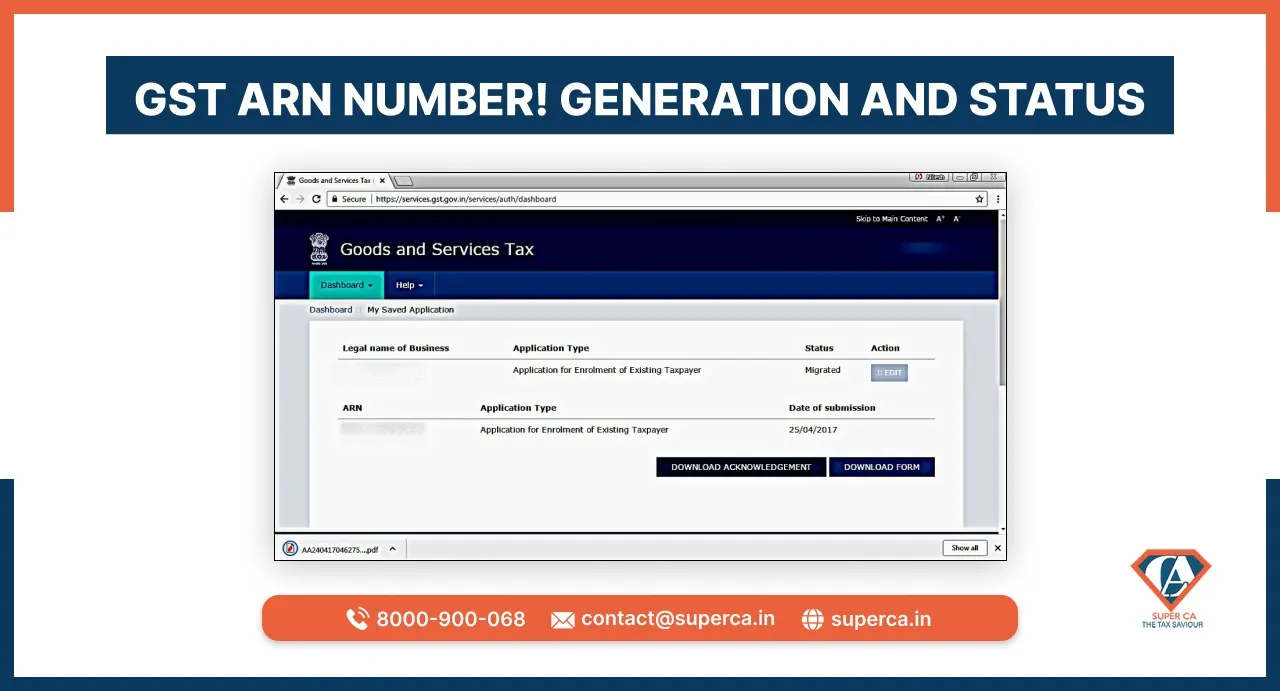

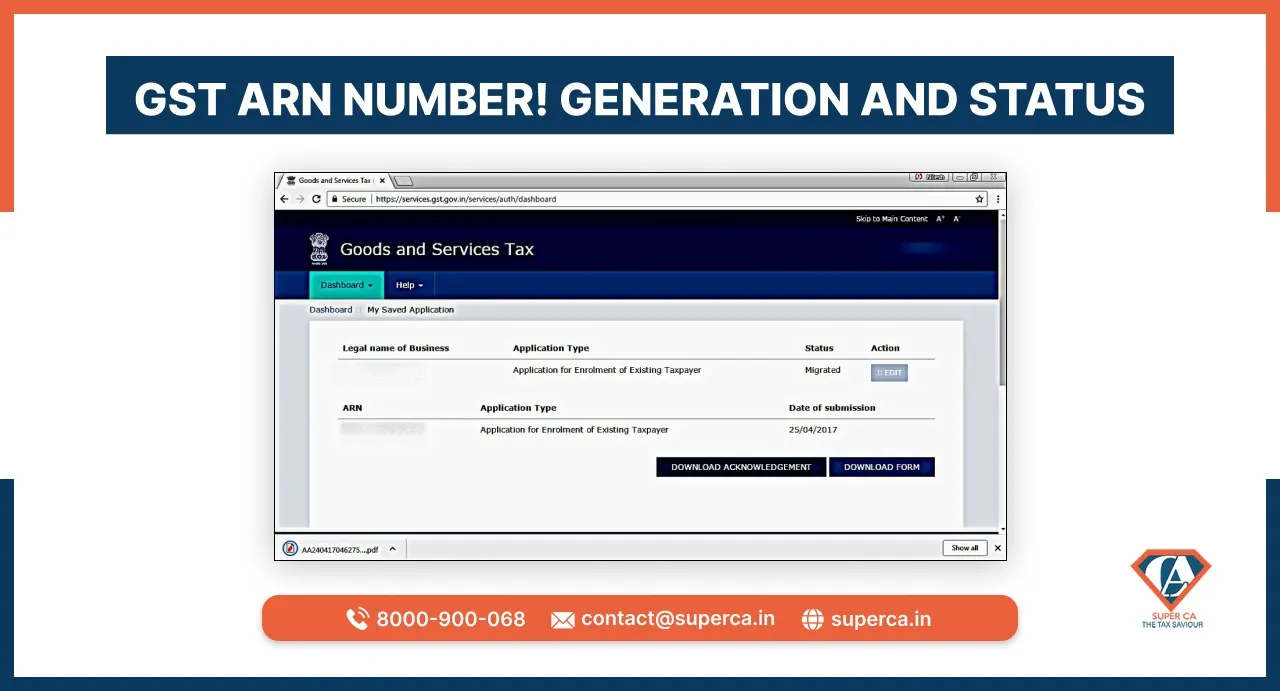

ARN is referred to as Application Reference Number. A GST ARN number is generated automatically on the GST Portal. This happens when a GST registration application is submitted on the GST Portal. It is also possible to track the status of a GST Registration Application with the help of the GST ARN Number until the government issues the GSTIN and GST Certificate.

Once the submission of the GST registration application has been done on the GST Portal, the GST ARN number will be generated. When the GST ARN Number has been generated, it becomes possible to track the GST Registration Certificate with its help.

Once an entity has obtained the GST ARN Number, then it becomes possible to check the status of the GST ARN online on the portal of GST. In order to check the status of GST ARN, one should follow the steps given below:

The various GST ARN Status along with their meanings have been discussed below:

An Assessing officer has been assigned the application of GST. Now, the GST application is in pending on the side of the government with an officer who has to process it.

A clarification has been requested by the processing officer on the filed application for the GST Registration. The clarification must be submitted through the GST Portal as soon as possible.

If the applicant has filed a clarification for the requests made by the GST Officer. An order will be provided soon.

If the applicant has not filed a clarification within the stipulated time period, then an order will be passed by the GST officer which will reject the application for GST registration.

In this, the GST officer has already approved the application for GST Registration and the applicant will soon receive the GSTIN and the application of GST registration.

In this case, the GST officer has rejected the application of GST registration. The applicant will have to apply for it again if he/she needs a GST registration.

In this blog, we discussed in detail the GST ARN number or the GST Application Reference Number. We also discussed its generation and the process to check the GST ARN status. We also learnt about the various types of GST ARN status and their meanings in detail.

|

Essential LLP Registration Documents: A Complete Checklist for Entrepreneurs Author: Rahul Singh 04 Apr, 2024

|

Get inspired by these stories.