Annual PF Return Filing - Form 3A & Form 6A| Explained

Provident fund was introduced by the government as a social security system. The main purpose of the provident fund was to provide financially secure retirement years to the employees. Any employer in India who has more than 20 employees can apply for PF registration.

Under the provident fund, employees and employers make contributions on a monthly basis and the employees can withdraw the provident fund contribution only at the time of his or her retirement except for a few conditions. In this blog, we will learn about the annual PF return filing and the forms which are needed to fulfil this purpose.

The annual returns need to be filed by April 30 of the concerned year. The forms which are needed in order to file annual PF returns are Form 3A and Form 6A.

Form 3 is also referred to as an annual contribution card of a member. Form 3A must include the signature and the seal of the employer who has filed the form.Form 3A is used to depict the monthly contributions which are made by the member and the employer for employee provident fund and Pension Fund in a specified year. This is computed for each and every member who is a part of the provident fund scheme. Along with these the key in will also include the details that are listed below:

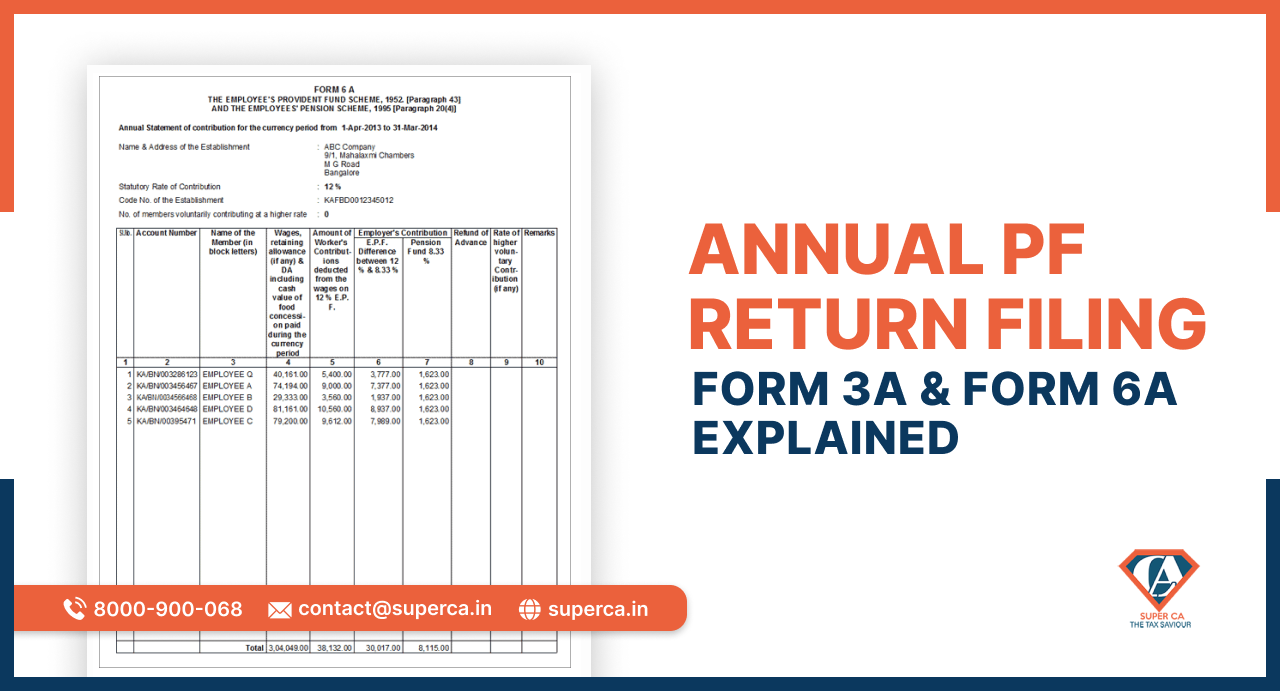

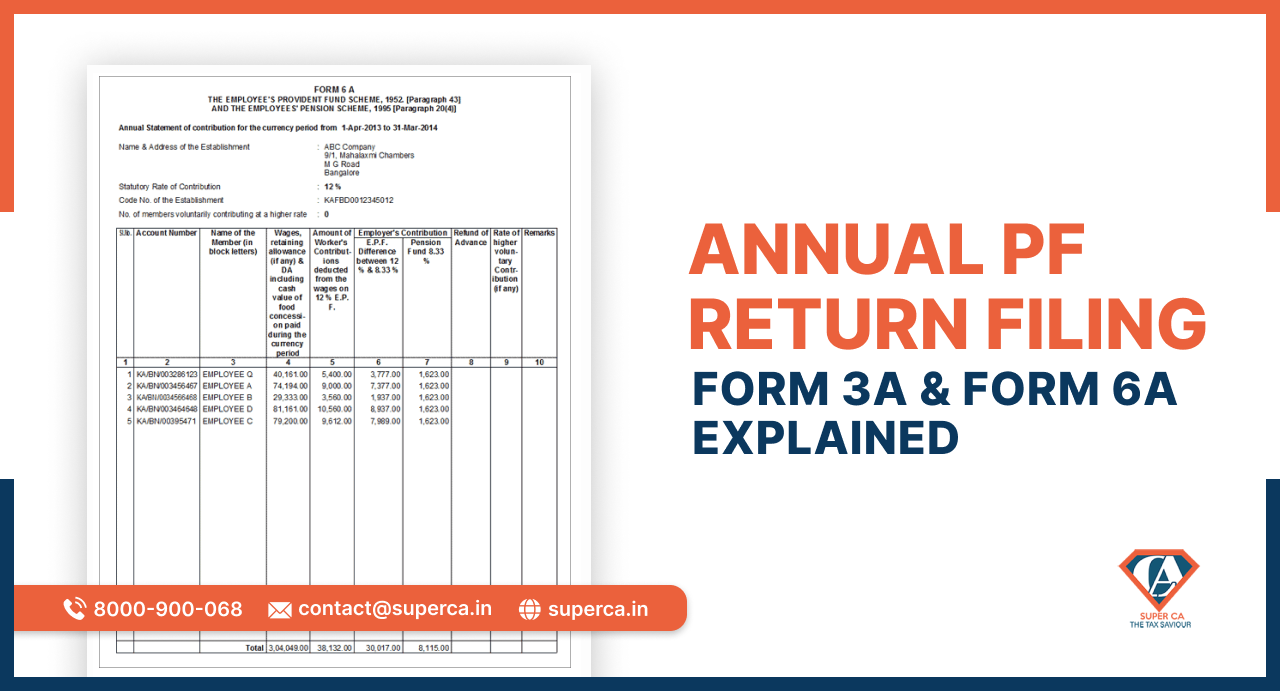

Form 6A is an integrated statement of annual contribution which consists of the details regarding the annual contribution made by each of the members of the establishment. The form must include the details listed below:

Other than all the details listed above the form must include the following details in the "amount remitted" column:

When an employer is given the responsibility for filing returns by using the forms mentioned above, the Employee Provident Fund Organisation known as the EPFO is directed to send an annual statement of accounts to each of its members or subscribers via their employers. The statement of accounts will contain the following details:

In this blog, we discussed provident funds and the annual PF return filing. We discussed the forms used to file PF returns annually that are Form 3A and Form 6A. We also came across the annual account statement for the annual PF return filing.

|

Essential LLP Registration Documents: A Complete Checklist for Entrepreneurs Author: Rahul Singh 04 Apr, 2024

|

Get inspired by these stories.